Auto-Enrolment Services

How Our Auto-Enrolment Services Work

Assessing The Situation

Before we can start enrolling your employees and submitting the necessary documentation, we need to assess the situation. If a previous accountant has provided you with auto-enrolment services, we will need to check what actions have been completed so far and what needs to be done.

Finding Your Staging Date

The next step is to check your staging date. This is the date when you are legally obligated to comply with auto-enrolment. Each company is different, but for most, it will be the date the payroll started to operate.

Determine Eligible Employees

Now we know your staging date, we need to determine which of your employees should be enrolled into the auto-enrolment pension scheme (see criteria below)

Enrol In Payroll Software

Once we have determined which employees must be enrolled and which are ineligible, we will need to perform the necessary actions to implement the scheme into our payroll software.

This will let us keep track of your employees and monitor any changes in their auto-enrolment.

Our software will then produce auto-enrolment letters that need to be distributed to your employees. We can forward these over to you, or distribute them ourselves with the appropriate permissions from your staff.

Setup Your Scheme

Now that auto-enrolment services have been taken care of within our software and on your employees pay documents, we need to set your scheme up with a pension provider. This will involve submitting documents, payroll information and employee details.

Once completed, you will then be ready to start making payments for your auto-enolment deductions.

Declaration of Compliance

The final stage of our auto-enrolment services is to submit your declaration of compliance. This declaration provides the Pensions Regulator with information about your business and its auto-enrolment situation, Ensuring you are compliant.

This declaration must be completed within 6 months of your staging date.

Who's Exempt From Auto-Enrolment?

If your business is exempt from auto-enrolment, you ill need to inform the pensions regulator by giving the a call, or using their online form

You can find a list of criteria below to determine your exemption:

- Your company only pays its director with no other staff

- Your company has been dissolved

- If a director does not have an employment contract

- Employees earning less than £10,000 per year

- An employee has handed in their notice

- They've received a 'winding-up lump sum' in the last 12 months

Get In Touch

Let’s Get To Know Eachother

What is Auto-Enrolment?

The government introduced auto-enrolment back in 2012 following a concern that UK employees were not saving enough for their retirement. Both the employee and employer will pay contributions based on your paydates and pay these over to your pension provider.

Who Does Auto-Enrolment Apply To?

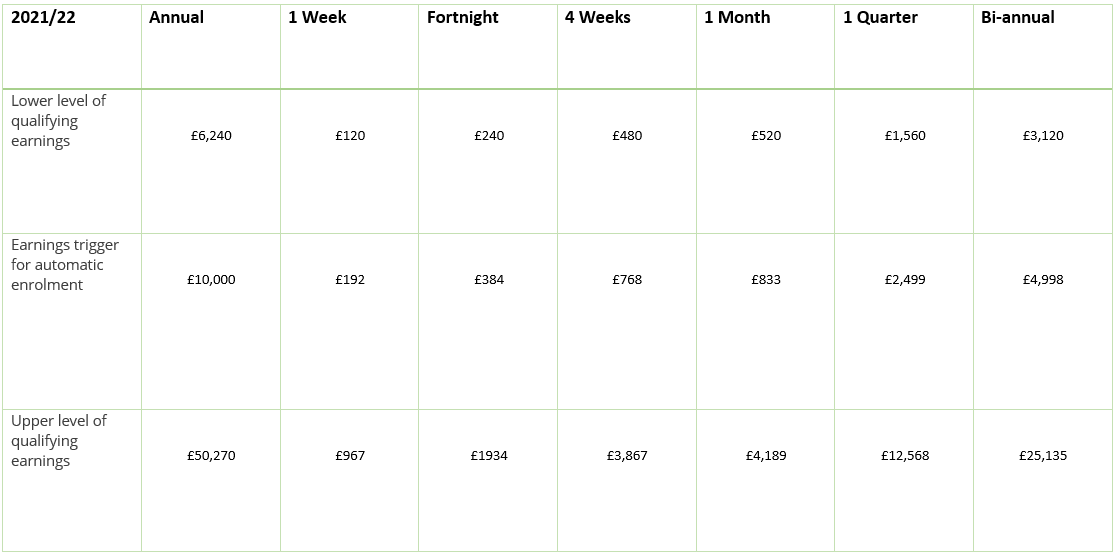

For an employee to qualify for auto-enrolment, they must meet a set of criteria. The employee must be of state pension age (22) and earn at least £10,000 per year. There is a lower earnings limit of £6,240 where the employee can join voluntarily. For a more detailed breakdown, you can use the table below.

What Do We Have To Contribute?

It is the employers duty to then pay these contributions over to your pension pot.

Interested In a Payroll Manager?

Learn more about how we can manage your payroll scheme.

Auto-Enrolment Compliance

We ensure all employees are dealt with accordingly by enrolling them or marked exempt as applicable. We will submit any necessary documentation to your pension provider so they are aware of your situation and understand who is enrolled and why.

Dedicated scheme manager

Reporting to pension provider

Secure data kept on our protected server

Auto-enrolment compliant

Necessary documentation

Letter distribution

Limited Company? We can help with your tax planning

Planning for minimal tax, maximum profits.

How We Can Help With Auto-Enrolment Duties

You can rest assured that your payroll is left in safe, and trustworthy hands. Making sure that you are fully compliant with all obligations.